Sell Your Florida Mortgage Note — The Smart, Stress-Free Way to Cash Out

At American Funding Group, we’ve been buying private mortgage notes in Florida for more than 30 years.

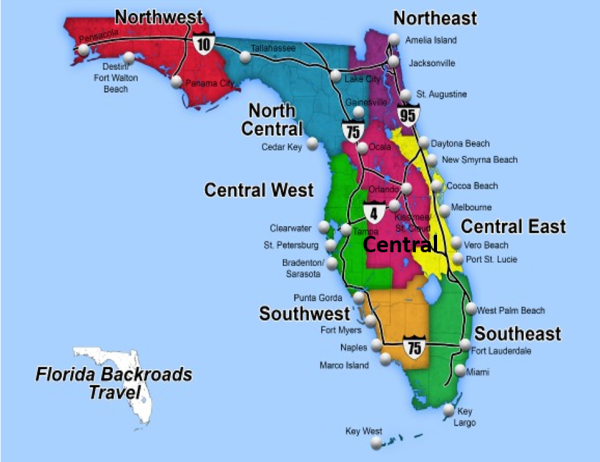

We buy mortgage notes in every county across Florida — from Miami-Dade to Duval, Hillsborough to Lee, Palm Beach to Escambia.

We’ve helped note holders throughout the Sunshine State turn their real estate paper into cash — even when other buyers said no.

Why Florida Note Holders Trust Us

- Veteran-owned and operated since 1989

- 30+ years buying mortgage notes nationwide — no brokers, no fees

- BBB A+ Rated

- 5.0★ Google Reviews|

- No brokers, no commissions

- Personalized solutions for complex notes

Maybe you’re holding a private mortgage on a vacation rental in Clearwater, a home in Fort Lauderdale, or an investment property in Gainesville—and now it’s time to cash in. Whether you’re tired of managing the paperwork, chasing payments, or just want to simplify your finances, American Funding Group is here to help you move forward with confidence.

We’re not just another national note buyer—we’re Florida-based, with over 30 years of experience helping people just like you sell private mortgage notes throughout the Sunshine State. As you are considering selling your Florida Mortgage note you might be interested in Florida Housing Market Data.

Why Sell a Mortgage Note in Florida?

Florida’s real estate market has been booming—but that boom brings both opportunity and uncertainty. With rising property values in places like Tampa, Naples, and St. Augustine, many note holders are wondering if now is the time to sell.

Florida’s market shifts quickly — especially in counties like Miami-Dade, Broward, Hillsborough, Lee, and Orange

Here’s why some noteholders across Florida are choosing to sell their mortgage notes:

Reinvest with Freedom

Use your cash to fund your next real estate deal, invest elsewhere, or simply take a breather.

Lock in Today’s Value

Don’t leave your money tied up in a note while interest rates and property values shift. When interest rates rise, your note value declines.

Get Paid in Full—Now

No more waiting month-to-month for payments. Get a lump sum when you need it most.

Skip the Tax Headaches

Avoid dealing with 1098s, amortization schedules, and bookkeeping every year

Common reasons Floridians sell:

- Retirement & Downsizing. Retirement is a great time to downsize and enjoy the fruits of our labor… a time to unleash the cash buried in your mortgage note

- Estate & Inheritance. Ease the burden of note management for your heirs. In our experience most heirs would rather deal with funds than the complexities of a note.

- Divorce Settlements. Most divorcees would rather avoid the complexities of dealing with their ex on a personal mortgage.

- Problem Borrowers. It can be a nightmare when dealing with late payments, lapses in hazard insurance and non-payments of real estate taxes.

- Investment Flexibility. Freeing up cash from your real estate note provides numerous opportunities to improve your life… paying for travel, new investment, reducing debt, etc.

💡 Selling turns paper into liquidity, giving you freedom to use

What Kind of Florida Notes Do We Buy?

From a single-family home in Naples to a mixed-use property in Orlando, we’re interested. We purchase almost any real estate-backed promissory note throughout Florida, including:

Residential Notes

We love buying mortgage notes on residentials property whether the property is owner occupied or is a rental.

Commercial Notes

If you’ve sold a commercial property or a residential property with more than four units with owner financing, we love buying commercial mortgage notes.

Land Contracts & Agreements for Deed

When Title to the property isn’t conveyed to the buyer at the time of the sale but is deferred until the loan is paid off, a Land Contract or Agreement for Deed is created. we love buying Land Contracts and Agreements for Deed.

Mortgage Loan Portfolios

We are major buyers of Mortgage Loan pools/portfolios. Call us at [phone] to get the process started.

Business notes

AT times. businesses are sold with owner financing. In these cases, there may be no real estate included. The sale includes the business name, good will, fixtufes and equipment. The underwriting required is much different than with real estate notes. Call us at [phone} to discuss.

See what your note is worth… Get a free, no-obligation quote today

📞 Call (772) 232-2383 or Get My Note Quote Now

The Process: Simple and Stress-Free

We’ve refined Our Florida Note Buying Process to be Fast & Easy over 30+ years to make it as smooth as possible:

Step 1 – Initial Consultation

![selling {market_state] mortgage note](https://image-cdn.carrot.com/uploads/sites/18179/2024/11/pexels-shkrabaanthony-5816297-1024x684.jpg)

Tell is about your note. No pressure. No obligation.

Step 2 – Evaluation

We assess your note’s value based of Florida’s & local market housing trends, interest rates & borr0wer strength

Step 3 – Receive Your Offer

You’ll receive a competitive s competitive, no hassle offer -typically within 24 hours.

Step 4 – Close and Cash Out

We handle all the paperwork and pay you promptly.

Whether you’re in the Panhandle or the Keys, we’re ready to help. Want more information? Call us at (772) 232-2383.

Real-Life Florida Note Seller Stories

- Maria in Miami (Miami-Dade County) – Inheritance

Maria inherited her father’s Miami home and mortgage note. Probate was overwhelming, and she didn’t want to track payments. By selling the note, she covered estate expenses and simplified her finances. - James in Tampa (Hillsborough County) – Divorce

James and his ex-wife co-owned a note from their former property. Selling the note let them split proceeds fairly and move forward cleanly. - Orlando Retirees (Orange County)– Partial Sale

A retired couple in Orlando needed cash for their grandchild’s tuition but still valued monthly income. A partial sale gave them the best of both worlds

What Determines the Value of Your Florida Mortgage Note?

Key factors:

- Borrower credit & payment history

- Property type (single-family, commercial, vacant land)

- Location (Miami, Tampa, Orlando generally fetch higher offers)

- Value of property, equity position, Loan-to-Value ratio

- Interest rate & term

- Number of payments left & Current Note Balance

Example: A $200,000 note secured by a Miami home with 7% interest and 5 years of on-time payments could sell for 90–95¢ on the dollar. The same note on vacant Panhandle land may fetch only 70–75¢.

📚 Related Florida Resources:

- How to Sell a Florida Mortgage note

- How to choose a Florida Note Buyer

- Avoid 7 Costly Mistakes when selling a Florida Mortgage note

- Your Complete Guise to Sell a Mortgage Note in Florida

- Avoid Emotional Stress after Divorce, Sell Divorce Note

- Can I Sell An Inherited Mortgage Note Without Probate?

- 5 signs of a Trustworthy Note Buyer in Florida

Why Choose American Funding Group?

We’re more than just experienced—we’re invested in Florida.

- Florida Headquarters in Jensen Beach. We’ve closed deals statewide from Monroe and Escambia Counties to Duval County. We understand local regulations and what matters to Florida note sellers.

- 30+ Years of Problem-Solving. We’ve helped thousands of private note holders—including many with “imperfect” notes that other buyers passed on.

- No Commissions, No Middlemen. We’re direct buyers—not brokers—so you get more money in your pocket.

- Personalized, not a call center. You won’t get passed around a call center. You’ll work with a small, dedicated team who knows your name—and your note.

We’ve purchased thousands of notes across Florida’s coastal, urban, and rural markets. To learn more about us check out our About Us page.

Let’s Talk About Your Florida Note

Whether you’re ready to sell now or just gathering information, we’re happy to talk. We’ll give you straight answers and a real offer—no games, no pressure.

📞 Call us now at (772) 232-2383 or

📝 Fill out the short form above to get started.

From the Emerald Coast to Palm Beach, American Funding Group is here to help you sell your Florida mortgage note quickly, safely, and confidently.

Check out what previous noteholders have said about dealing with us.

Our team of Florida note buyers offers professional service, allowing you to sell all or part of your note quickly and easily.

Say goodbye to the headaches of collecting payments and managing the accounting for your note. We handle it all, streamlining the process for you.

Don’t hesitate to reach out to us at (772) 232-2383 for any inquiries or simply fill out the short form on this page to get the process started! Keep in mind that we buy mortgage notes in other states as well.

Want the Most Trusted Mortgage Note Buyers?

Popular Florida Areas We Serve

We actively buy notes in:

- South Florida: Miami, Fort Lauderdale, West Palm Beach

- Central Florida: Orlando, Kissimmee, The Villages

- Treasure Coast: Jensen Beach, Stuart, Port St. Lucie

- Tampa Bay Area: Tampa, St. Petersburg, Clearwater

- Panhandle: Pensacola, Panama City

- Southwest Florida: Fort Myers, Naples, Cape Coral

Even if your property is in a small town or rural area—we want to hear from you!

Unlock the Value of Your Mortgage Note

Allow us to be your trusted partner in selling your Florida mortgage note. Our team is here to offer you a straightforward, transparent, and process.

If you’re ready to turn your Florida mortgage note into cash, we’re ready to make it happen.

📞 Call (772) 232-2383 today to speak with a local expert

📩 Or just fill out the short form below and we’ll get back to you fast

We’ve been helping Florida note holders for over three decades—and we’d love to help you, too.

Curious what your note is worth? Request your no-obligation Florida quote today.

👉 Let’s chat today at (772) 232-2383! Or Get Started Below:

![] mortgage note buyers](https://image-cdn.carrot.com/uploads/sites/79478/2024/09/suburban-street.jpg)

See how we can help you!

American Funding Group, is a premier note investor, buying notes in all states. We specialize in residential and commercial performing real estate notes in the US. We love helping note holders who are in tough situations. We will work with you to find a win-win solution so you get the most from selling your real estate note.

📞 Call (772) 232-2383 or Get My Note Quote Now

Or Give Us A Call Now At: (772) 232-2383

Popular Florida Areas We Serve

Frequently Asked Questions

Can I sell just part of my mortgage note in Florida?

Yes. This is called a partial sale. You get cash for a set number of payments while still keeping future income.

Do I need a lawyer to sell my mortgage note in Florida?

Not usually. Most deals are handled directly with the buyer. Probate or divorce-related notes may benefit from attorney guidance.

How fast can I sell a mortgage note in Florida?

If your documents are ready, 3–4 weeks is typical. Probate or missing paperwork can add time.

What if my mortgage note is non-performing?

Non-performing notes can still be sold. Buyers evaluate the property and foreclosure options to make an offer. If you are considering foreclosure, get help from the Florida Court System.

Does Florida weather risk affect my note sale?

Sometimes. Homes in hurricane-prone areas may fetch lower offers, but good insurance coverage offsets much of the risk.

Can I sell an inherited mortgage note without probate in Florida?

If it’s in a trust or joint name, you may not need probate. If it went through probate, you’ll need the court’s transfer paperwork.

Does property value affect my note offer in Florida?

Yes. Notes secured by homes in strong markets like Miami or Tampa typically sell for higher prices than rural or vacant land notes.

Do you buy mortgage notes statewide in Florida?

Yes. — we buy notes in every Florida county, from Miami-Dade to Escambia, Hillsborough to Palm Beach, Orange to Lee.

We buy mortgage notes nationwide, not just in Florida. See our full coverage here: We Buy Notes in All 50 States. Or compare your options on our Nationwide Note Buyer page