Mistakes to avoid when You Want to Sell a Mortgage Note in Florida

If you own a private mortgage note in Florida, you’re sitting on a valuable asset — but selling it isn’t as simple as finding a buyer and cashing a check. Over the past 30+ years, I’ve seen note sellers leave thousands of dollars on the table because of avoidable mistakes.

Whether you’re selling because you need quick cash, want to simplify your finances, or just don’t want the hassle of collecting monthly payments, avoiding these pitfalls can help you get the highest possible price and a smooth transaction.

If you want to skip the guesswork and work directly with a trusted Florida note buyer, check out our Florida Note Buyers page to learn how we’ve helped thousands of note holders turn paper into profit.

Let’s cover the 7 costly mistakes when selling a Florida Mortgage Note.\

Mistake #1: Not Knowing Your Note’s True Market Value

Many sellers guess at their note’s worth or rely on outdated information. The reality? Note value depends on several factors:

- Remaining balance

- Interest rate

- Payment history

- Property value

- Buyer’s credit profile

Without a professional evaluation, you risk accepting an offer that’s far below market value. At American Funding Group, we provide free, no-obligation valuations so you can make an informed decision when you want to sell a Mortgage Note in Florida.

Mistake #2: Accepting the First Offer You Receive

It’s tempting to take the first offer, especially if you’re in a hurry. But mortgage note buyers’ offers can vary widely. Shopping around is important — but not just for the highest number.

Look at the terms, fees, and buyer reputation. A high offer doesn’t mean much if the buyer can’t close or tries to renegotiate later.

Mistake #3: Failing to Verify the Buyer’s Reputation

Of All the mistakes when Selling a Florida Mortgage Note … not verifying the note buyer’s reputation can be most costly.

Not all note buyers are created equal. Some are experienced, ethical professionals. Others are middlemen looking to “flip” your note, adding delays and reducing your payout.

Before you sign anything, check the buyer’s track record, online reviews, and length of time in business. Our team has been buying mortgage notes for over three decades — and we close deals quickly, without hidden surprises.

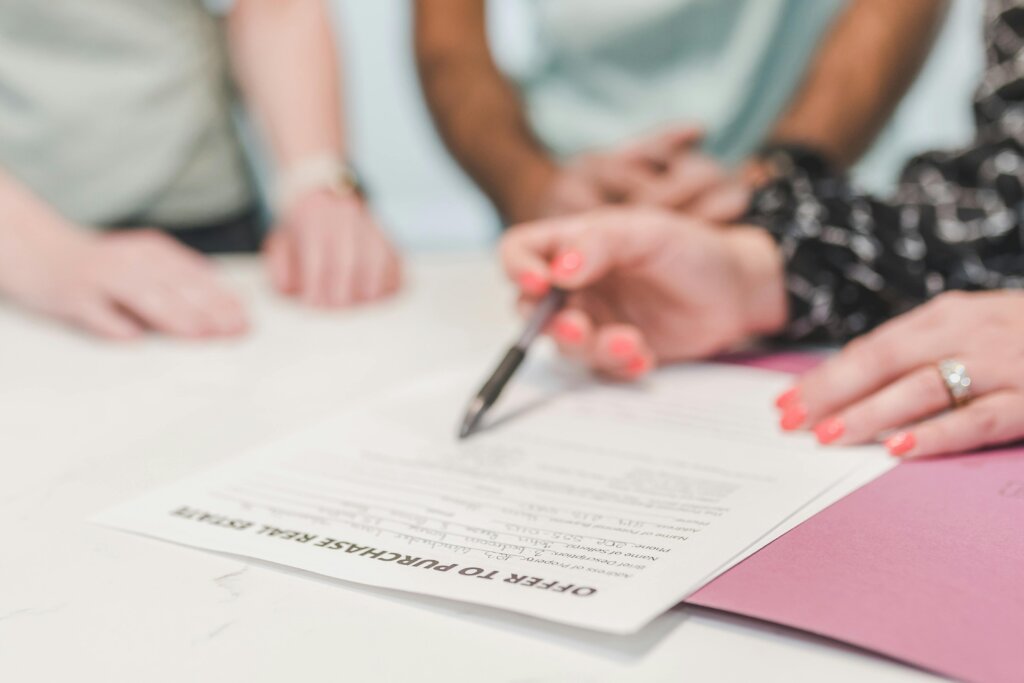

Mistake #4: Overlooking Documentation Issues

Incomplete or inaccurate documents can kill your deal. Make sure you have:

- Original promissory note

- Recorded mortgage or deed of trust

- Payment history records

- Any modification agreements

If you’re missing paperwork, a reputable Florida note buyer can often help you track down or replace key documents — but waiting until the last minute to fix issues can delay closing. Get all your documentation together before talking to note buyers.

Mistake #5: Ignoring the Benefits of Partial Note Sales

Many note holders think they must sell their entire mortgage note — but that’s not always true. One of the big mistakes when you want to sell a Mortgage Note in Florida, is not exploring the benefits of a partial note sale. This partial sale lets you sell just a portion of your future payments for a lump sum now, while keeping the rest, which you will receive in the future. Make sure your note buyer explains what happens in the event of an early payoff.

This can be a smart strategy if you need cash now but want to keep long-term income. At American Funding Group, we customize partial sale offers based on your goals. We will make sure that you understand every step of the note buying process.

Mistake #6: Not Considering the Tax Implications

When you are looking to sell a mortgage note in Florida, don’t overlook the tax consequences…. especially if you sell it for more than you originally paid for the property or note. A qualified accountant can help you understand capital gains tax and other considerations.

A professional note buyer can also structure the sale in a way that minimizes your tax liability.

Mistake #7: Waiting Too Long to Sell

If interest rates rise or the property’s value drops, your note’s value could decrease. Similarly, if the payer’s credit situation worsens or they miss payments, buyers may lower their offers.

If you want to sell a mortgage note in Florida… it pays to act while your note is performing well and the market is strong.

How to Sell a Mortgage Note in Florida Without the Hassle

The best way to avoid these mistakes is to work with an experienced buyer who will:

- Give you a fair, upfront offer based on current market conditions

- Handle the paperwork

- Close quickly

- Offer flexible selling options (full or partial)

At American Funding Group, we’ve been helping Florida note holders turn their notes into cash for over 30 years. We understand the Florida real estate market and can give you the best possible deal for your situation.

If you’re ready to explore your options, fil out the form below or visit our Florida Note Buyers page to request a free, no-obligation quote.

📞 Call (772) 232-2383 or Get My Note Quote Now

We Buy all TyPES OF REAL ESTATE NOTES

We can help you with all kinds of situations

American Funding Group is helping noteholders all over the United States who need to sell their real estate note quickly and for a fair price.

Default

Is your borrower in default or about to be?

Frustrating Borrowers

Do you have problem borrowers who periodically miss payments?

Need for Cash

Need cash to pay off debt, an emergency, investment or education?

Burden of IRS reporting

Want to get rid of required IRS record keeping and reporting?

Inherit or Probate

Did you inherit an unwanted home or a real estate note?

Unlock Funds Quickly

Need to unlock your funds buried in your real estate note?

Avoid Commissions

Do you want to avoid paying agent or note broker commissions?

Insurance & Taxes

Is your borrower behind on taxes? No Property pride of ownership?